When BidRush enters a new city, two worries always come up:

- “Will there be enough bidders?”

- “What do the fees actually look like?”

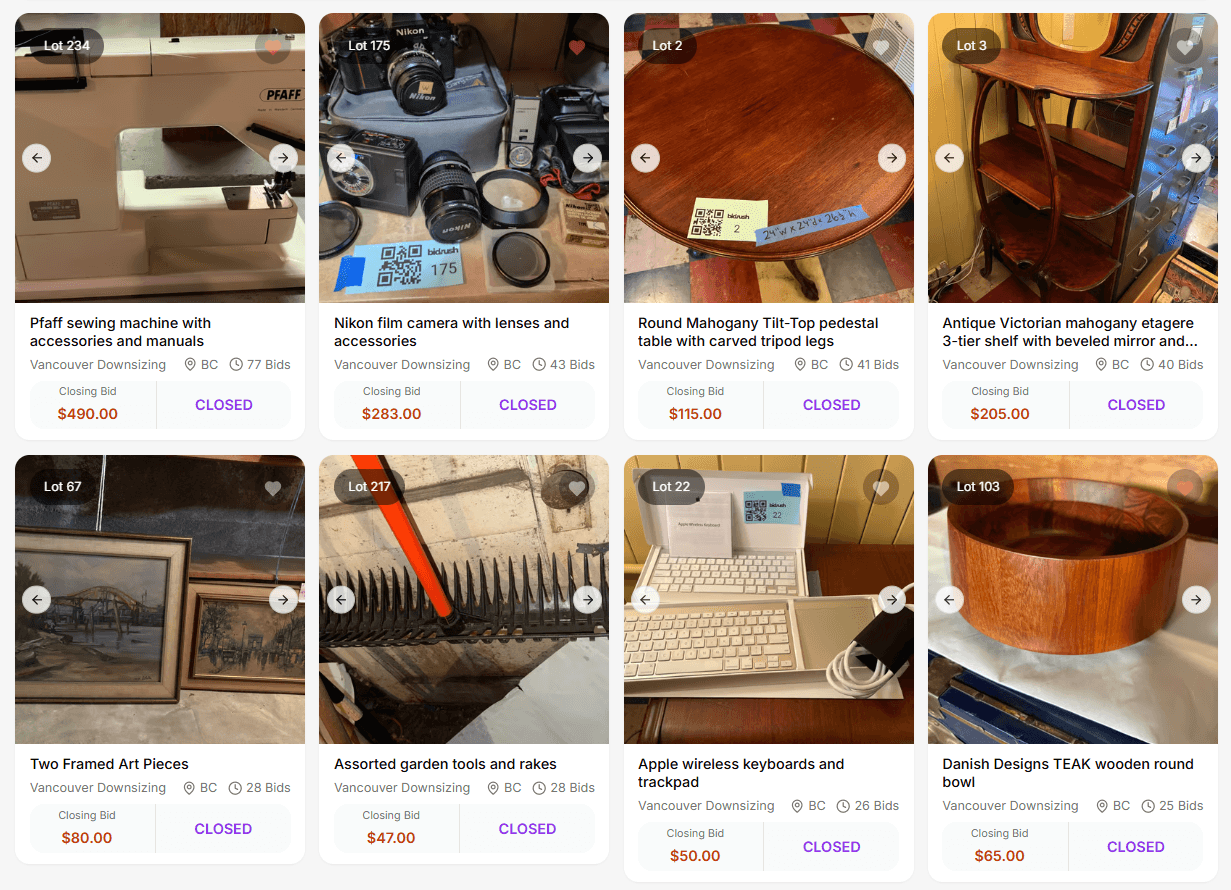

The BidRush Vancouver Downsizing Auction for Out of Chaos Professional Organizers and Move Managers answered both — decisively.

There was no pre-existing audience (other than a specialty comic/coins auction). No local following. However, the BidRush team has done it in 30+ markets previously, so we knew exactly how this was doing to unfold.

What happened next shows exactly how BidRush builds bidder momentum in new markets and ensures sellers keep far more of the final sale price ($1000+ in this case study, an amount that is hard to ignore).

Day 1–2: Quiet on the Surface — Signals Underneath

The auction opened with just three bids totaling $3.

By day two, roughly 8% of items had bids.

To a new seller, this stage always feels uneasy. But behind the scenes, momentum was already forming:

- Visitors were adding items to watchlists.

- Early bidders were testing the waters.

- The marketplace flywheel began its first turn.

Day 3–5: The Market Finds Its Pulse

By the midpoint of the auction, momentum accelerated:

Total bids grew from 26 to 381

- Sell-through jumped from 8% to 46%

- 70+ bidders registered

- 120+ watchlisters followed items

Most lots had 2–3 genuinely interested bidders — and that’s all it takes to reach full-market pricing when the auction mechanics are designed well.

Day 6–7: Engagement Turns Into Energy

The night before closing:

- 681 total bids placed

- 61% of lots already competitive

- 140+ items active or sold

This engagement curve matched what we’ve seen in other new markets. When activity is transparent and fair, it naturally compounds.

Closing Day: The Curve Explodes

In the final 24 hours, everything ignited:

- Bids surged from 681 to 1,865

- Sales jumped from $1,496 to $4,343

- - Sell-through exceeded 90%

Timed extensions ensured fair competition and avoided last-second sniping — giving items time to find their competitive footing.

The result: a brand-new market generating competitive bidding and Sellers Keeping More With BidRush

The Vancouver auction produced $4,343 (plus a 10% $434 buyer’s premium that seller set and keep). Here’s how that unpacks:

BidRush Fees:

- $521 (12% of hammer)

- $155 Stripe fees (2.9% of all fees and taxes)

-Total BidRush Fees: $676

- (10% Buyer's Premium goes to Seller, NOT the Platform)

Previous Platform Fees:

- $1303 (30% of hammer)

- $781 (18% buyer's premium kept by platform)

- Total Previous Platform fees: $2084

- -(18% Buyer's Premium goes to platform, NOT the Seller)

BidRush net return: $4,101 (95%) of total collected Which is $4343 - $676 fees + $434 (10% Buyer's Premium given to seller)

Previous Platform net return: $3,040 (59%) of total collected Which is $4343 + $781 (18% Buyer's Premium collected) - $1303 (30% of hammer) - $781(18% Buyer's Premium collected kept by platform)

Difference: +$1,061 more kept with BidRush (95% of total collected vs. 59% total collected)

$1000+ in savings is hard to ignore!

Even if the previous platform discounted their rate to 15%, the combined 15% + 18% buyer’s premium still total $1,433 — meaning BidRush leaves sellers and buyers $757 better off, even under “discounted” conditions. This isn’t a small difference. That’s money that stays in the community instead of disappearing into platform fees.

In an economy where every dollar counts, the choice is clear: Fiduciary responsibility means choosing the $676 fee solution vs the $2,084 fee solution. Book your onboarding call with BidRush today.

"We recently completed an auction with BidRush and could not be more pleased with the results. With over 90% of lots sold, this meant that contents went to people who wanted the items and this helped to divert items that may have went to landfill. The sales proceeds help to mitigate the costs of final removal costs of less than 10% of contents remaining. So a great experience using the BidRush platform. Both we and our client were delighted!" - Linda Chu, Out of Chaos Professional Organizers and Move Managers.